Making Complicated Payroll, Simple

Learn more about how our payroll software can help streamline your back office operations by taking a look at our payroll solution overview.

widget_1704820294746, .description p, default 16

widget_1704820294746, .text_block p, default 16

widget_1704820294746, .top_content p, default 16

See Why Companies Everywhere

Use Our Payroll Software and Services

widget_1704822066701, .description p, default 16

widget_1704822066701, .text_block p, default 16

widget_1704822066701, .top_content p, default 16

Simple to Use Report Writer

PayBridge’s Report Writer help you securely create web-based reports on your employees and business KPIs in just a few steps

widget_1700813903845, .item_1 .it1 .adv-left-rich-text p, h4_size

widget_1700813903845, .item_1 .it2 .adv-left-rich-text p, default 16

Create custom-formatted fields, record sorting and grouping with detailed drill-downs, and benefit from the multiple output selections.

Automatically retrieve KPIs, print graphs and charts, identify workforce analytics and access business intelligence data - to address current business practices, prepare accurate forecasts and align daily operations with company goals.

Access PayBridge’s report library, where over 600 customizable reports are available via site workflow panels, menus and dataset queries.

Reporting features include:

widget_1700813903845, .item_1 .it1 .adv-right-rich-text p,

Online dashboard with multiple KPI displays for at-a-glance business analytics

Interactive business intelligence outputs

Author and publish reports

Analyze “what if” scenarios

Configure interactive metrics for performance effectiveness, overall business performance, and goal forecasting

24/7, on-demand report access for executives, managers, administrators and key personnel

widget_1700813903845, .item_1 .it2 .adv-right-rich-text p, default 16

widget_1700813903845, .item_1 .adv-top-content p,

Top-of-the-Line Data Security

All of our applications and data are hosted and protected with Amazon Web Services - the leading provider of cloud storage. Security controls include monthly vulnerability management scans, antivirus software and encryption of all client data. Clients using our cloud-based software can customize security rights so individual users only have access to what you choose.

widget_1700813903845, .item_2 .adv-top-content p,

Easy Auditability

As a company, PayBridge must pass SOC 1 and SOC 2 Type 2 audits on a regular basis. SOC audits are completed by an independent third party to ensure all necessary controls and systems are in place. PayBridge is compliant with the strictest privacy standards, including the Health Insurance Portability and Accountability Act (HIPAA) and General Data Protection Regulation (GDPR).

widget_1700813903845, .item_3 .adv-top-content p,

Affordable Care Act (ACA) Tools

Access a comprehensive suite of tools to easily understand your Affordable Care Act (ACA) responsibilities. Assess and report on employees’ eligibility status, monitor and maintain employee’s ACA compliance, and avoid unnecessary liability.

Receive reports including:

widget_1700813903845, .item_4 .it1 .adv-right-rich-text p,

Forms 1094 B/C and 1095 B/C

ACA Full-Time Employee (FTE) Report

ACA Eligibility Analysis Report

Rule of Parity Report

Inactive Employee Report

ACA 1095 Edit Report

1095 Preview Report

ACA Affordability Report

ACA Status Report

widget_1700813903845, .item_4 .it2 .adv-right-rich-text p, default 16

widget_1700813903845, .item_4 .adv-top-content p,

"Pay-As-You-Go" Workers’ Compensation

widget_1700813903845, .item_5 .it1 .adv-left-rich-text p, h3_size

widget_1700813903845, .item_5 .it2 .adv-left-rich-text p, default 16

While traditional workers’ comp policies require you to estimate how much payroll you might do in a year, transfer funds for insurance and then conduct an audit against actual payroll totals - you can avoid overpaying or underpaying with a pay-as-you-go policy. Our policy partners integrate with our payroll service to calculate exactly how much your business owes in workers’ comp each payment period.

widget_1700813903845, .item_5 .it1 .adv-right-rich-text p, default 16

A 25-100% premium deposit required

Premium based on estimated annual payroll

Limited payment terms (e.g. monthly, quarterly, semi-annual, annual)

Greater risk of additional premium due at year-end audit

Need to handwrite checks and send via mail risking late payment or cancellation

No premium deposit required

Premium based on actual payroll instead of estimates

Payments evenly spread over company’s policy period

Reduced risk of over or underpayment at year-end audit

Eliminates writing checks and assures accurate, on-time payments

widget_1700813903845, .item_5 .it2 .adv-right-rich-text p, default 16

We work with best-in-class workers’ compensation policy providers to provide all of the following benefits:

widget_1700813903845, .item_5 .it3 .adv-right-rich-text p, default 16

No premium deposit required

Premium based on actual payroll

Reduced audit exposure

Increased cash flow

widget_1700813903845, .item_5 .it4 .adv-right-rich-text p, default 16

widget_1700813903845, .item_5 .adv-top-content p,

Payroll Integration Ability

Easily update your accounting system

Simplify your reconciliation process with general ledger integration. Payroll data can be automatically uploaded to your accounting system, and seamlessly integrated with QuickBooks Online. Learn more about our payroll integrations.

One-click import of labor hours

Automate time entry with payroll tax management software, removing the need to key time and attendance information into payroll separately.

Convenient, fully-integrated solutions

Run a more efficient business by meeting all of your Human Capital Management needs using a single sign-in. Learn more about how to benefit from an integrated human capital management system.

401(k) interface

Seamless 401(k) integration supports businesses that help their employees save for retirement. Easily sync 401(k) to payroll so enrollment is streamlined and automated; reducing processing time, improving accuracy, security, and resource optimization.

Inbuilt compliance

Our tax management engine is continuously updated in accordance with federal, state, and local laws and tax rates, tax brackets and statutory limits.

widget_1700813903845, .item_6 .adv-top-content p,

Payroll Tax Management Services

Payroll is already complicated; multi-state payroll tax management can be overwhelming.

Each state has different tax rules, different payroll tax forms and different payroll tax rates. If you have employees working remotely, staying compliant with state and local laws can be difficult to navigate.

PayBridge stays on top of over 11,000 taxing agencies throughout the U.S. and Canada ensuring compliance, and since every company is unique, our payroll tax solution is custom-built around your specific needs.

Our solution will help you stay compliant and up to date on tax laws and rates, whether you're a small business looking for a little guidance or a full-service payroll tax management partner.

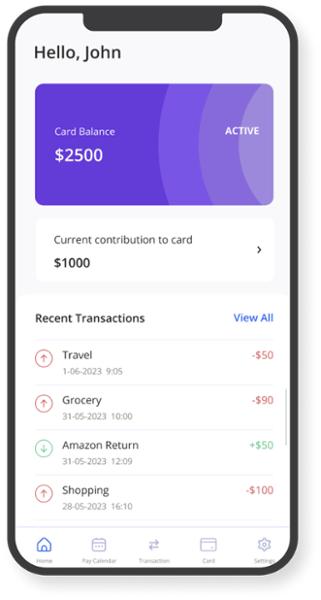

WageLink

PayCard and On-Demand Pay

WageLink teaches employees how to save and helps them manage unexpected expenses

widget_1712595021516, .description p, default 16

widget_1712595021516, .text_block p, default 16

widget_1712595021516, .top_content p, default 16